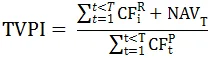

A return multiple that relates the current value of remaining holdings within a private equity fund plus the total value of all distributions to date to the total amount of capital received by the fund to date. In this sense, it results from adding the distributed value to paid-in ratio (DVPI) to the residual value to paid-in ratio (RVPI):

Where: NAVT is the net asset value of the fund’s holdings at the time of calculation; CFP denotes the cash flows paid in to the fund in the form of capital invested and fees paid; CFR refers to the cash flows distributed by the fund on past investments (it includes the return of uinvested funds and stock distributions);

TVPI provides a quite reasonable measure of investment performance towards the end of a fund’s life. This ratio usually reflects the minimum level of return that investors would expect from their investments in a fund.