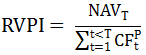

A return multiple that measures the net asset value (NAV) of a private equity fund relative to the amount of capital provided by the limited partners (LP) to the fund. The unrealized multiple (also: residual value to paid-in ratio or RVPI) reflects the current value of all remaining holdings within the fund compared to the total amount contributed to date by the investors. This ratio is given by the following formula:

Where: NAVT is the net asset value of the fund’s holdings at the time of calculation; CFP denotes the cash flows paid in to the fund in the form of capital invested and fees paid.

This ratio particularly suits private equity funds in early stages of their life cycle (i.e., when funds have not yet made much of income distribution).