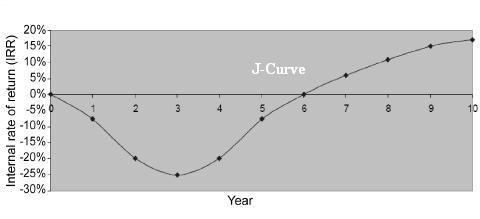

The pattern that is followed by the value of a private equity fund‘s interim internal rate of return (interim IRR) over the fund’s life. During the inception years of a fund, this value tends to be zero or negative. In the mid-life of a fund or later towards the final years of its life cycle, interim IRRs turn increasingly positive with the passage of time. The following exhibit depicts a generalized j-curve of a private equity fund:

The zero or negative values arise from financing the fund’s management fees and start-up costs out of the first drawdowns. Furthermore, investments are conventionally valued, according to the industry’s best practices and guidelines, at acquisition cost at inception. As the fund develops over time, it would start to make cash distributions to its investors which help compensate their initial investment (therefore, interim IRRs become positive and increase towards the end of the fund’s life.