In relation to private equity (PE) and venture capital (VC) funds, it is the discount rate that makes the net present value of cash flows plus the latest net asset valuation (NAV) from (a fund/ an investment, etc.), equal to zero (for an interim period over the course of a fund’s or investment’s lifecycle). The net asset valuation (net asset value) is the fund’s share of the investment’s market capitalization at the measurement time, often net of the management fee and carried interest.

It is an internal rate of return (IRR) that assumes an appraised terminal value (appraised value) where interim period occurs prior to the end/ expiration date of the investment and a certain appraised value is used for the interim period’s cash flows.

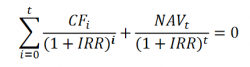

The interim internal rate of return (interim IRR) is alternatively known as the dollar-weighted return as it takes into account both the proportion and timing of cash flows. It can be presented as a discount rate at time t in the following formula (equation):

It is referred to, for short, as IIRR.