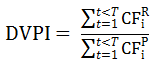

It stands for distributed value to paid in ratio: a return multiple that is used to assess the investment performance of a private equity fund. It is a ratio that relates distributions to the limited partners (LP) to the amount of capital provided by these partners to the fund. The DVPI is given by the following formula:

Where CFR denotes the cash flows distributed by the fund on past investments (it includes the return of uinvested funds and stock distributions); CFP is the cash flows provided to the fund such as capital invested, fees paid, etc.

This return multiple measures the net performance of invested funds relative to all costs (such as fees, carry,..) and investment outlays. The DVPI is especially instrumental for a fund that is nearing the end of its life because the capital committed must have been fully invested by or around that time.

This measure is also referred to as a realized multiple.