An asset that produces portfolio income. The income of a paper asset is derived from the performance (income and capital changes) of its underlying asset. In this sense, a paper asset is a vehicle that allows market participants to convert or channel their savings into investments. For individuals and entities, an investing that involves paper assets is a powerful way to build wealth with minimal efforts.

The main examples of paper assets include stocks, bonds, insurance, annuities, traded funds, mutual fund shares (and broadly financial securities). A fiat currency that is issued by a creditworthy government, and hence is used as a reserve currency, is also a paper asset (e.g., US dollar, euro, etc.)

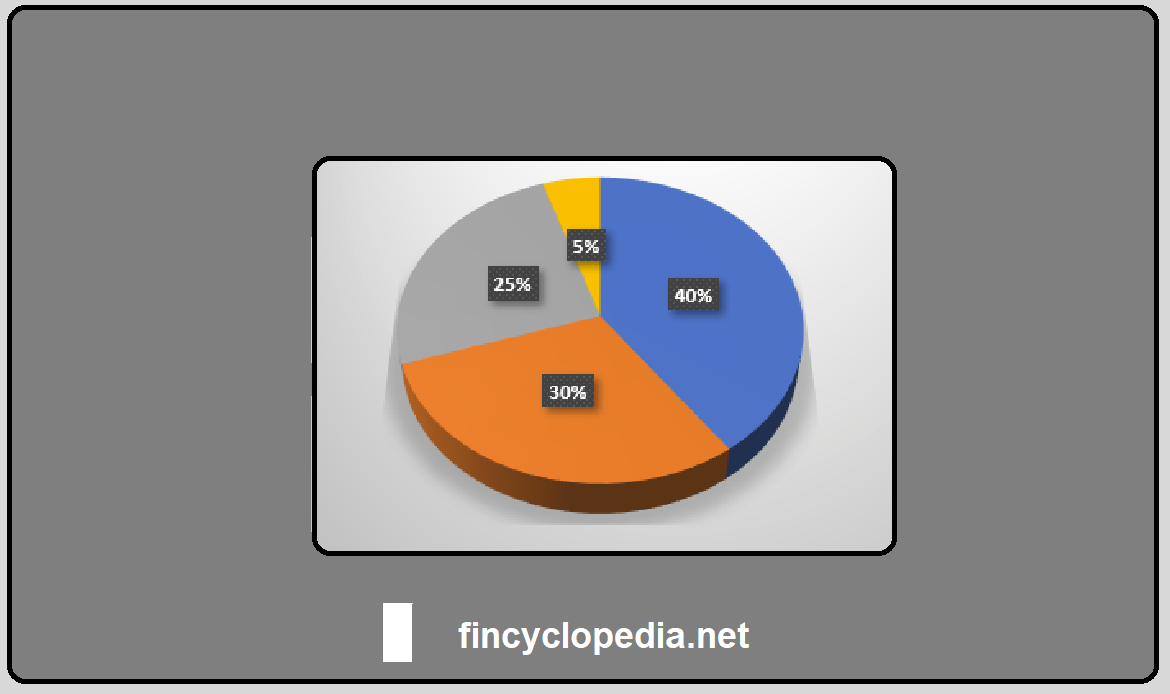

Portfolio income represents capital gains that arise from buying paper assets at a lower cost or price and selling them for a higher price, with the difference being the capital profits. In reality, this investing style is much more a way of trading (rather than investing), because it focuses on buying and selling at two different points in time. This type of income is taxed at much lower rate compared to earned income (usually, 20% vs. 50%) and hence is considered a better level of income generation that comes with certain benefits.

Individuals who are typical to make this type of profits (portfolio income) are at a professional advantage to earners of “earned income” in terms of their ability to work on their own business (self-employed) and to directly apply their professional knowledge and know-how.

In a different context (paper asset in accounting), it is a type of asset carried on an entity’s statement of financial position (balance sheet) that cannot be converted into cash, either quickly or easily. Such an asset is of no direct use to the entity, and which it cannot sell for financial gains.