The growth rate of an investor’s purchasing power. It the interest rate that takes into account the effect of inflation. More specifically, it is equal to the nominal rate of interest minus the inflation rate:

Real rate of interest = nominal rate of interest – expected inflation rate

The occurrence of inflation means that the real rate of interest is lower than the nominal rate. For example, if the inflation rate over a period of 12 months is 4%. This indicates that an 8% annual nominal interest rate charged on a $10,000 loan will, in effect, amount to a 4% real interest rate. Therefore, the nominal rate is reduced by the loss of purchasing power caused by inflation.

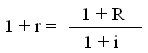

The above equation of the relationship between the real and nominal interest rate is approximate. The exact relationship is given by:

Where: r is the real rate; R is the nominal rate; i is the inflation rate.

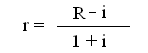

This implies that the growth factor of purchasing power equals the growth factor of money divided by the new price level. It follows that the exact relationship can be rearranged as follows:

This shows that the approximate equation is an overestimation of the real rate by 1+ i.