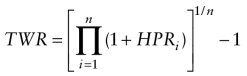

It stands for time-weighted return; a type of total return that measures the performance of a dollar invested in for the entire measurement period. It is given by the following formula:

TWR= [(1+R1) x (1+R2) x … x (1+RN)1/n] -1

Or:

Where: HPR is the holding period return and n is the number of holding periods.

This rate assumes compounding and reinvestment of gains and income earned in subperiods (holding periods). The expression (1+ subperiod decimal return) is usually known as a wealth relative, return relative, or growth rate. The growth rate captures the increase in capital over the subperiod, which is determined as the ratio of the ending market value to the beginning market value.

Comments