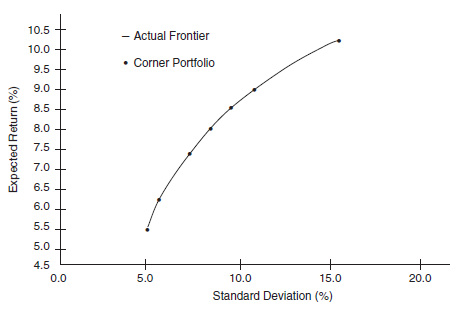

A portfolio where a security either enters or leaves the efficient set. In other words, it consists of all securities (or assets in general) that are added to the efficient set when we move from one point to another on the efficient frontier. In this sense, a corner portfolio constitutes a section of the minimum-variance frontier within which there are sets of identical assets and the rate of change of asset weights (within each set) in moving from one to another doesn’t vary. As the minimum-variance frontier goes through a corner portfolio, an asset weight either changes from zero to positive or from positive to zero. The global minimum variance (GMV) portfolio remains included as a corner portfolio regardless of its asset weights. Therefore, corner portfolios are instrumental in creating other minimum-variance portfolios.

For example, assume there is a corner portfolio with an expected return of 7 percent and an adjacent corner portfolio with expected return of 9 percent. The asset weights of any minimum-variance portfolio with expected return between 7 and 9 percent is a positive weighted average of the asset weights in the 7 percent and 9 percent expected-return corner portfolios.

Needless to say that adjacent corner portfolios are part of the efficient frontier. Like corner portfolios, the linear interpolates between successive corner portfolios are also efficient portfolios.