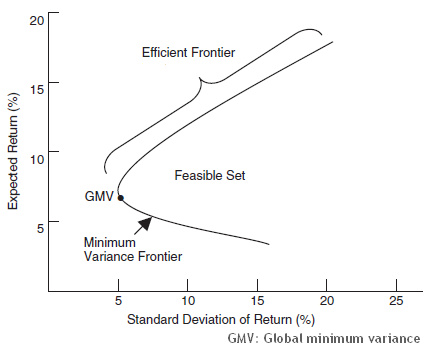

A continuum of portfolios that generate the highest expected returns for their given levels of risk (standard deviation) plotted in combinations of expected return and standard deviation. in terms of risk-return dimension, efficient portfolios dominate all other portfolios and individual securities, which exist below the efficient frontier. In order to establish a strategic asset allocation, investors typically choose among efficient portfolios on the efficient frontier taking into account, of course, consistency with an investor’s risk tolerance.

The efficient frontier is convex towards the axis of expected return as all assets have a correlation between positive unity and negative unity [+1, -1]. The efficient frontier can never be concave to the vertical axis because assets with perfect positive correlation can only generate a linear combination of risk and return. Portfolio diversifiers prefer efficient frontier portfolio.

The efficient frontier is part of the minimum-variance frontier (MVF).