A measure of risk (value at risk or VaR) that assumes market-related factors follow certain stochastic processes (as defined under Monte Carlo simulation). The stochastic processes, per se, depend on (a function of) Wiener process.

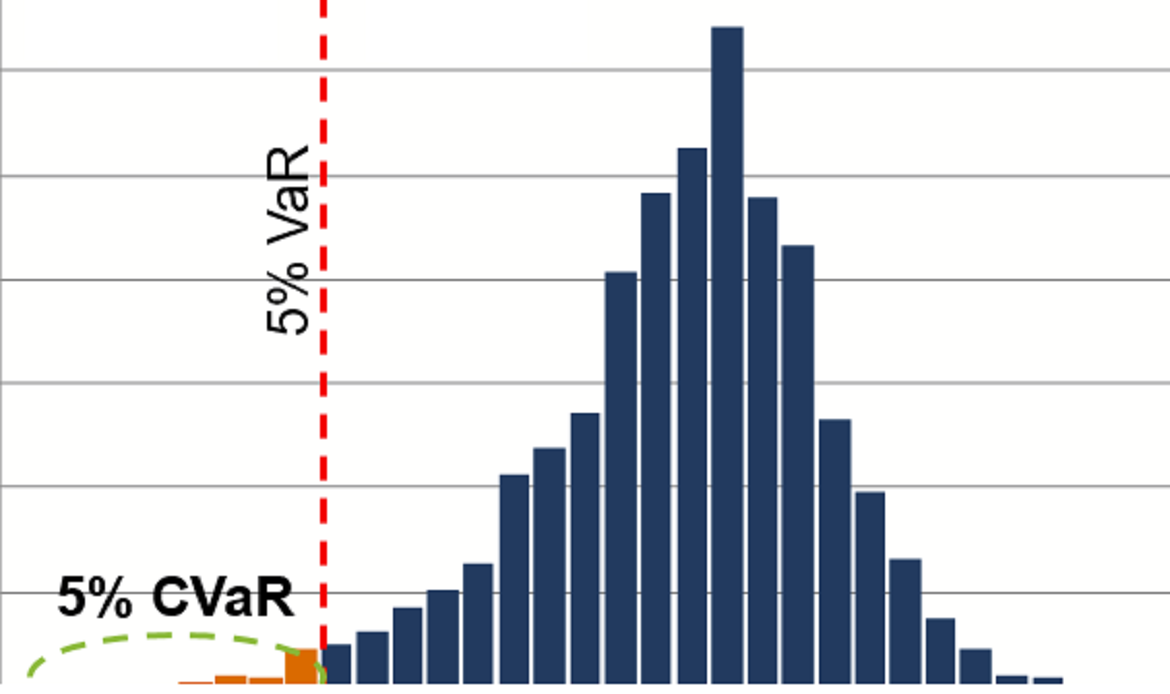

Given that, the measure calibrates volatility for each market factor and pair-wise correlation for any pair of market factors, and then simulate market factor changes considering the stochastic processes and correlated random variables. Market scenarios are generated and then present values of different scenarios are calculated. Profits and losses pertaining to all scenarios are arranged for comparison, with the figure at 1% lowest level representing the value at risk (VaR).

For this type of value at risk measure, backtesting and stress test a can be easily carried out, and it suits high confidence level and tail risk. However, it remains assumption-based, and is dependent on distribution assumption and calibration and extensive calculations would be required.

A Monte Carlo value at risk is a model value at risk.