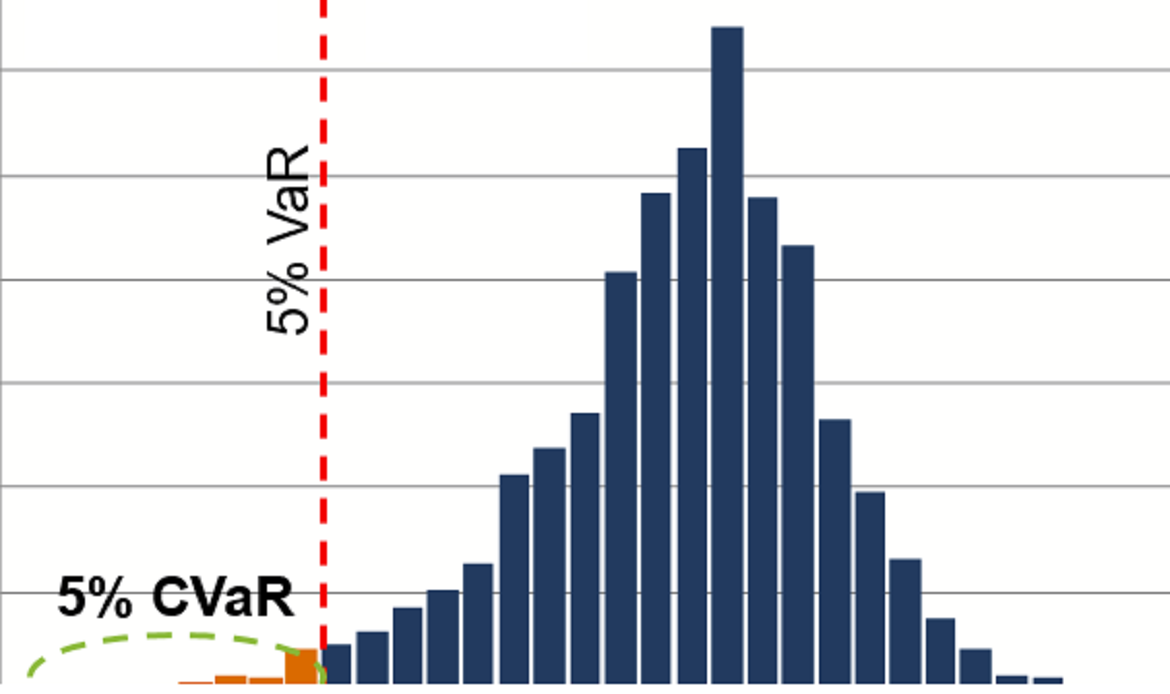

A type of value at risk (VaR) that represents a monetary estimate of risk using statistical techniques to figure out the maximum probable loss, with a certain confidence level, that a financial position or portfolio may incur in a given period (holding period) due to changes in the risk factors applied by the measurement models that reflect market dynamics.

The management of an entity uses a set of mathematical and statistical models for calculation of VaR, using parametric approaches (variance/ covariance) and approaches based on simulation techniques. These models have defining characteristics that are set by the management such as type of simulation model (e.g., historical simulation model) based on the mark-to-future platform, confidence interval (e.g., a 99th percentile confidence interval), method of revaluation of positions, and disposal period. The management defines historical simulation scenarios- e.g., based on time series of time-bound risk factors (and a given set of observations),.

For management purposes, a non-equal probability of occurrence is assumed for each scenario as a function of time, to assign higher importance to most recent data. For regulatory purposes, scenarios are equally weighted when calculating respective capital requirements.

Managerial VaR is calculated in many forms such as daily managerial VaR, average managerial VaR, total managerial VaR, and market managerial VaR.