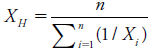

A measure of the mean that equals to the reciprocal of the arithmetic mean reciprocals. More specifically, it is the number of terms (observations) divided by the sum of all their reciprocals. First, we average the reciprocals of terms, then take the reciprocal of that average. Symbolically, the harmonic mean of a portfolio is:

Where: n is the number of terms; Xi is the ratio of an individual holding of asset (i).

Calculation of the harmonic mean varies from one type of a series to another. Generally, there are three types of series: individual series (represented by the above formula), discrete series, and continuous series. The harmonic mean is always less than the arithmetic mean. In fact, it produces a value that is lower than not only the arithmetic mean but al the geometric mean.

Comments