Concept of NFTfi

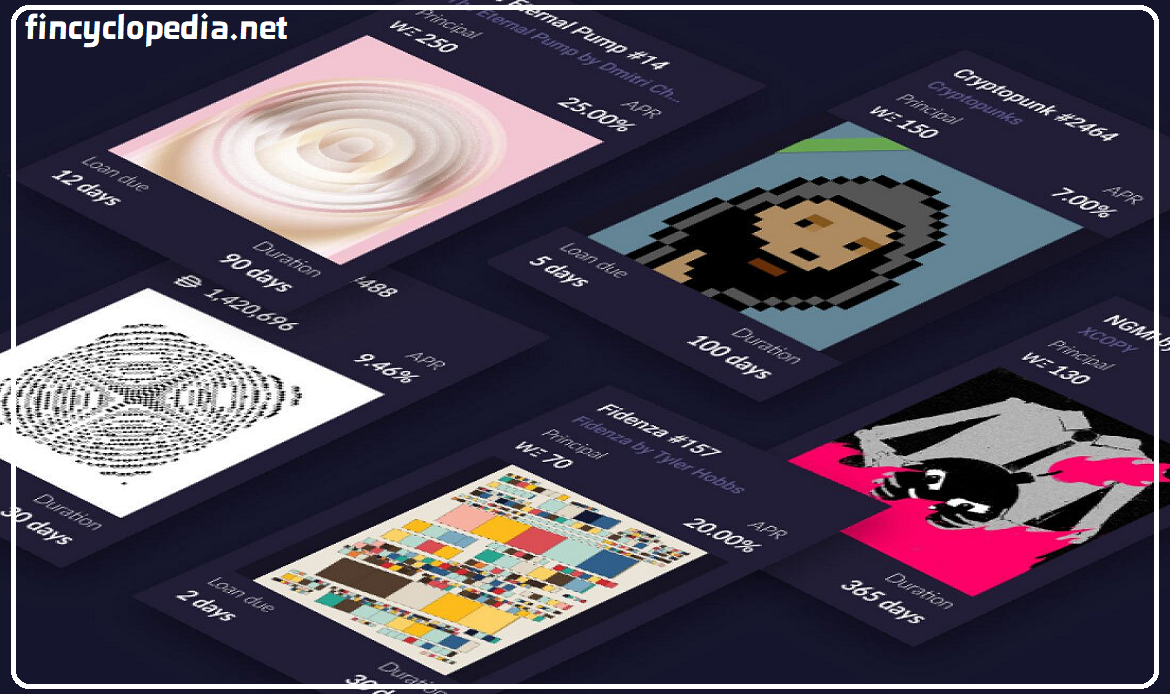

An NFTfi stands for non-fungible token on decentralized finance/ DeFi (or for short, NFT finance or non-fungible token finance). NFTs (non-fungible tokens) have dramatically changed the digital asset landscape, enabling unique ownership of a unique breed of assets such as digital art, collectibles, and virtual real estate. However, NFTs are often illiquid, that is, no returns will be generated while such tokens are stored in the online or offline wallets. Then the concept of NFTfi (non-fungible token on DeFi) emerged, narrowing and bridging the gap between NFT ownership and decentralized finance (DeFi). On NFTfi platforms, users can avail their holdings by lending their NFTs to others against interest or sort of renting, or can borrow NFTs by providing collateral.

NFT finance represents an ecosystem of decentralized protocols and applications providing financial utility (such as crypto loans) to or against NFTs. NFT holders can take part in initial NFTfi offerings (INOs) by placing their NFTs as collateral, against which fungible tokens (often called NFTfi tokens) are issued to them. The issued tokens can be traded or used within the network (to which these tokens are native – native tokens). For example, a lady owning a rare digital artwork NFT can participate in an INO, placing her NFT as collateral, and in return receiving NFTfi tokens. These token holdings entitle her to have a share of the platform’s revenue or governance rights (in the same manner like a governance token). For the borrowers, tokens can be used in virtual space, gaming, or as additions to profiles. For example, a gentleman may seek to use a well-known virtual land NFT in the virtual world. He can borrow it from the NFTfi platform by placing collateral (often in the form of stablecoins or certain types of NFTs).

Advantages of NFTfi

As a protocol, NFTfi is introduced as a means by which the financial utility of NFTs can be enhanced and made more efficient, thereby bringing to the NFT market and different participants a bunch of benefits, mainly including 1) wider availability (and accessibility)- which positively impacts market liquidity, 2) improved financial utility, and 3) better risk mitigation mechanisms.

Enhanced Liquidity

By nature, NFTs bear distinct features and are indivisible (sort of one of a kind thing), which makes them not liquid, thereby negatively impacting the liquidity of the NFT market. NFTfi protocols enable the use of NFTs as backing assets for crypto loans. The so-called fractionalized NFTs (fungible units of NFTs) can be traded on decentralized exchanges, and new entry enhances the functionality of the NFT market itself. The outcome is an establishment of of a more liquid and efficient marketplace for this category of digital assets.

Improved financial utility

NFTfi protocols contribute to the financial utility of NFTs for both holders and market participants by creating an advanced market structure these digital assets. Specifically, lending and financing venues provide a more liquid marketplace to NFT holders. These protocols also provide an opportunity for counterparties (lenders) to make money on their loans extended to NFT holders, and hence, a new opportunity for income generation arises and adds to the set of incentives available to lenders. NFT fractionalization also increases market access to different categories of participants, while placing at NFT owners’ disposal much needed liquidity with retention of complete control over their assets.

Better risk management for assets

NFTfi protocols provide users with additional options for gaining exposure to the NFT market or the ability to hedge market volatility. Market players can also better manage their exposures thanks to certain market mechanisms such as indexing of a basket of assets and prediction markets. Using NFT indices, market exposure can extend to the entire market or to specific sectors of verticals. With better data available to market players, prediction markets help owners of NFTs to reduce market volatility and risk to acceptable levels.