Concept

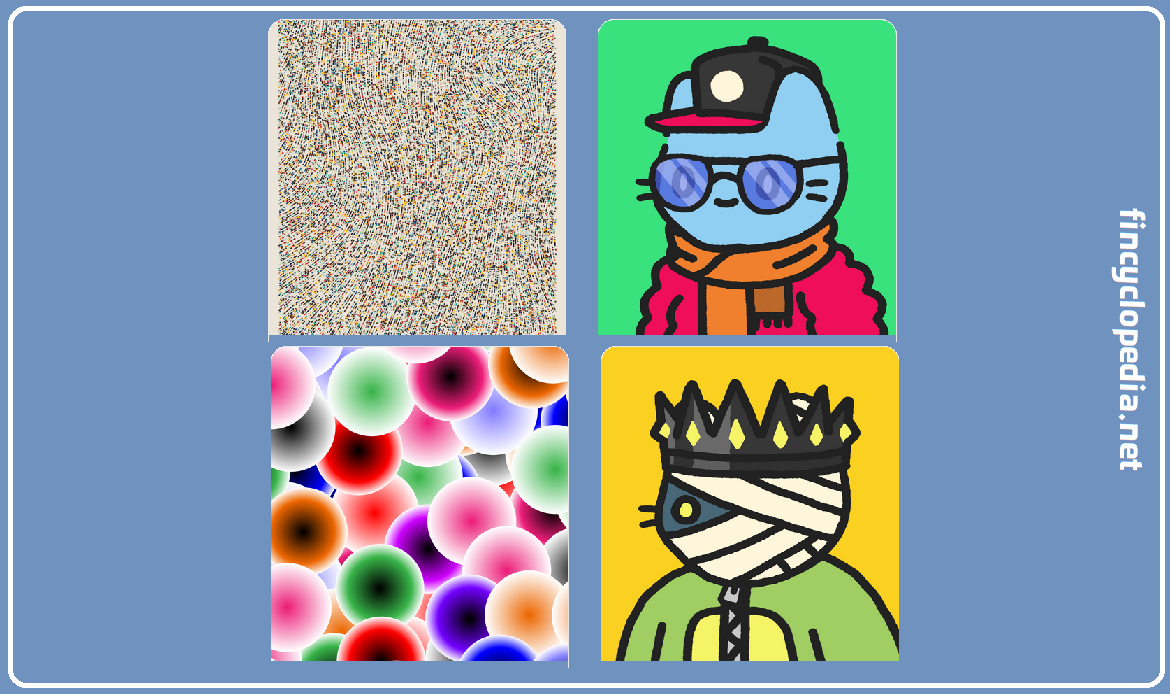

NFT derivative is a sector within non-fungible tokens (NFTs) on decentralized finance (NFTfi) (broadly, the NFT industry). This derivative represents a tradable contract whereby market participants can take view on potential NFT market direction- i.e. potential prices of NFT collections over time. The underlying NFT collections combine characteristics and design elements from popular NFT projects. The derivative contract closely replicates the economic value and performance of the original non-fungible tokens used as underlying, in addition to possessing or reflecting an identical visual shape. Popular NFT collections (e.g., CryptoPunks), provide a potential underlying for certain derivatives. Furthermore, certain projects can be used simultaneously as subject-matter of derivative contracts. An NFT derivative may combine features from two different projects (e.g., Doodles and BAYC). Broadly speaking, these derivatives enable certain market sectors to utilize and capitalize on creative assets and the intellectual property of existing NFT projects.

NFTfi

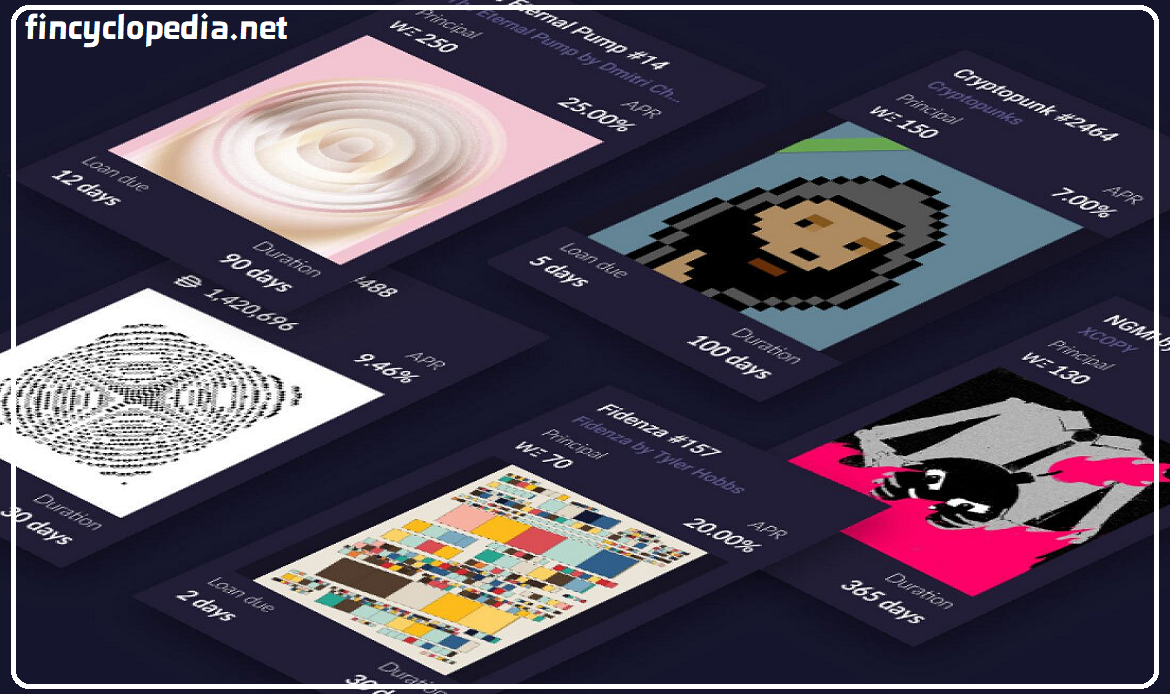

An NFTfi stands for non-fungible token on decentralized finance/ DeFi (or for short, NFT finance or non-fungible token finance). NFTs (non-fungible tokens) have dramatically changed the digital asset landscape, enabling unique ownership of a unique breed of assets such as digital art, collectibles, and virtual real estate. However, NFTs are often illiquid, that is, no returns will be generated while such tokens are stored in the online or offline wallets. Then the concept of NFTfi (non-fungible token on DeFi) emerged, narrowing and bridging the gap between NFT ownership and decentralized finance (DeFi). On NFTfi platforms, users can avail their holdings by lending their NFTs to others against interest or sort of renting, or can borrow NFTs by providing collateral.

NFT finance represents an ecosystem of decentralized protocols and applications providing financial utility (such as crypto loans) to or against NFTs. NFT holders can take part in initial NFTfi offerings (INOs) by placing their NFTs as collateral, against which fungible tokens (often called NFTfi tokens) are issued to them. The issued tokens can be traded or used within the network (to which these tokens are native – native tokens). For example, a lady owning a rare digital artwork NFT can participate in an INO, placing her NFT as collateral, and in return receiving NFTfi tokens. These token holdings entitle her to have a share of the platform’s revenue or governance rights (in the same manner like a governance token). For the borrowers, tokens can be used in virtual space, gaming, or as additions to profiles. For example, a gentleman may seek to use a well-known virtual land NFT in the virtual world. He can borrow it from the NFTfi platform by placing collateral (often in the form of stablecoins or certain types of NFTs).

Role and modus operandi

A derivative contract may operate as a distributed ethereum smart contract allowing participants to mint their own NFT which is designed to tracks an existing NFT project. NFT derivatives derive their value and significance from the popularity of NFTs and their wider adoption in the NFT markets that capitalize on DeFi. Mustering the ability to tap the potential reward generation opportunities which can be provided by popular non-fungible token collections, these type of derivatives can help create an active market for a class of assets that are characteristically illiquid and non-tradable. For collectors, this instruments offer an alternative to establish a connection with certain preferred high-profile collections for which no sufficient financial resources would be at their disposal. For example, Cool Cats is a collection of 9,999 randomly generated and stylistically curated NFTs that are developed and issued on the Ethereum blockchain. Cool Cat holders can benefit from certain exclusive rights such as NFT claims, raffles, and community giveaways.