Concept

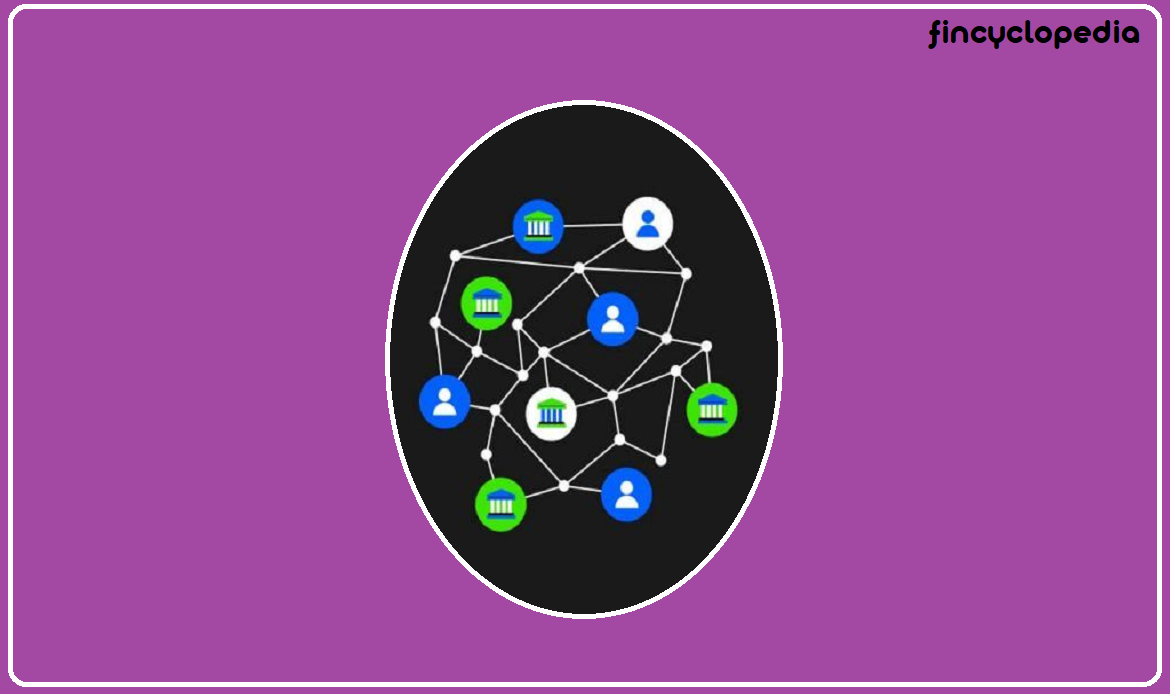

A decentralized finance token (DeFi token) is a digital token that allows users to take part in a crypto space/ ecosystem, whether for transactions or decision making (vote on any governance proposals submitted by the community), as well as to benefit from other exclusive features provided on the platform. Decentralized finance (DeFi) offers a variety of supportive and security tools for blockchain ecosystems, so that users can manage their crypto assets, carry out transactions in a secure manner, and utilizing certain enabling tools such as smart contracts. The DeFi tokens grant holders the rights to participate in governance (of the own network), access exclusive features and benefits, and stake for rewards (in the form of network tokens – by means of staking).

A DeFi token is issued and traded on its platform utilizing the facilities provided by decentralized finance (DeFi). This type of financial protocol is a blockchain-based and -operated financial system where users and other market players can conduct transactions (trades, transfers, exchanges, etc.), in a direct way, and without intermediaries, involving tools such as smart contracts. Decentralized finance (DeFi) is a broad term for the universal system of blockchains and all applications that operate there in order to allow users to transact directly with each other using cryptocurrencies such as Bitcoin and other certain types of digital tokens.

Main types

These tokens have many types including utility tokens, governance tokens, equity tokens, and security tokens.

- Utility tokens are a tokenized form of a utility such as computation power, cloud space, file sharing, etc. The underlying service is a programmable blockchain asset. These tokens provide a kind of consumer membership and access to services or other scarce resources. This mainly involves pre-selling a specific service and using the sale proceeds to build the needed structure or to further develop and improve existing structure. For example, utility token on computation helps the issuer harness the power of an extended number of devices that are put in daily use in order to distribute computation utility across the network.

- Governance tokens allow holders to take part, and play a role, in on-chain governance for a crypto project (a blockchain based or run project). These tokens are used to vote on certain proposals and decisions, and to influence or determine the future direction of a project in the ecosystem. The token is issued as an incentive, allowing the user (holder) an opportunity to become a partial owner (direct stakeholder) and decision-maker in a DeFi protocol. Governance tokens are linked to a specific DeFi protocol and purport to provide holders with certain rights and/ or with voting rights on future alternations to certain features of a protocol. However, the tokens do not allow the holders to gain control over the protocol at the enterprise level. Normally, a governance token entitles the holder to a single vote, and votes can also be delegated (through proxy) by respective holders who do not wish to take part in the voting process. Given that the amount of tokens can dictate the proportion of voting power in the hands of owners, governance voting systems characteristically encourage plutocratic decision-making and concentrates power in the hands of the wealthy.

- Equity tokens represent ownership in equity instruments/ interests such as stocks and shares in funds (and any form of equity share in a business, venture, etc.) These tokens allow fractional or partial ownership of ventures or net assets, providing access to equity markets through blockchain. As an asset-backed token/ asset-referenced token, this category of tokens is often offered by means of a security token offering (STO) and reflect an actual value due to correlation with an external, real-world asset’s value. Hence, the tokens allow secure, fast and cost-effective trading of equities (as traditional assets) via blockchain technology, adding to liquidity of such traditional assets.

- Security tokens are digital forms of a tangible or intangible asset. A security token/ tokenized asset represents a divided share in the ownership of real, financial, or digital assets that is recorded on a blockchain in the form of digital tokens. By means of an asset tokenization, an issuer creates digital tokens on a distributed ledger or blockchain, which represent.