Concept

A wrapped token is a type of digital token (digital asset) that represent cryptocurrencies and similar assets on non-native blockchains, so that they can be used outside of their original networks. Wrapped tokens enable cross-chain compatibility and provide more liquidity to the market. Additionally, these assets provide more flexibility of decentralized finance (DeFi) ecosystems. Wrapped tokens operate by locking the original cryptocurrency in a digital vault (the original network) and issuing a new token on a different blockchain that reflects the original asset’s value.

Wrapped tokens are linked to a certain coin but can operate on a different blockchain network. For example, wrapped bitcoin, or WBTC, is a cryptocurrency that derives its value from bitcoin pricing but may be used on other networks, e.g., the Ethereum network. Wrapped tokens are perceived as stablecoins relatives, that are designed to enhance interoperability between different blockchains. Hence, these tokens enable cryptocurrencies from one blockchain to be used on another, and hereby overcoming certain limitations on an original blockchain, and maintaining the value of the respective underlying assets.

Main types

A wrapped token allows different uses and the transfer of value across various blockchains. Particularly, it cross-functions and interoperates on non-compatible cryptocurrencies and blockchains. For example, a wrapped token can be exchanged on its non-native blockchains, and can be redeemed (or “unwrapped”) for the underlying asset. For wrapped tokens to seamlessly operate, a custodian (custodians can be a vendor, a multisig wallet, or a smart contract, among others) holds an equivalent amount of the asset as the wrapped amount.

As far as types are concerned, it is historically established that stablecoins were the first type of wrapped tokens, though it substantially differs from other types of wrapped coins. Stablecoins represent and are backed by a corresponding amount in a fiat currency (e.g., USDT (Tether), for example, is backed by roughly one dollar). However, a stablecoin does not only reflect the value of physical currencies held in the account. The value of stablecoin holdings reflects a wider base of assets or reserves, including items such as cash, cash equivalents, investments, and loan receivables.

In terms of settlement mechanism, wrapped tokens can be classified as cash-settled (cash settled tokens) and redeemable (redeemable tokens):

- Cash-settled tokens are those that are settled in cash and cannot be redeemed for the underlying asset.These tokens are backed by a reserve of fiat currency or other assets.

- Redeemable tokens allow investors to exchange the wrapped token with the underlying asset as they are backed by the underlying asset itself.

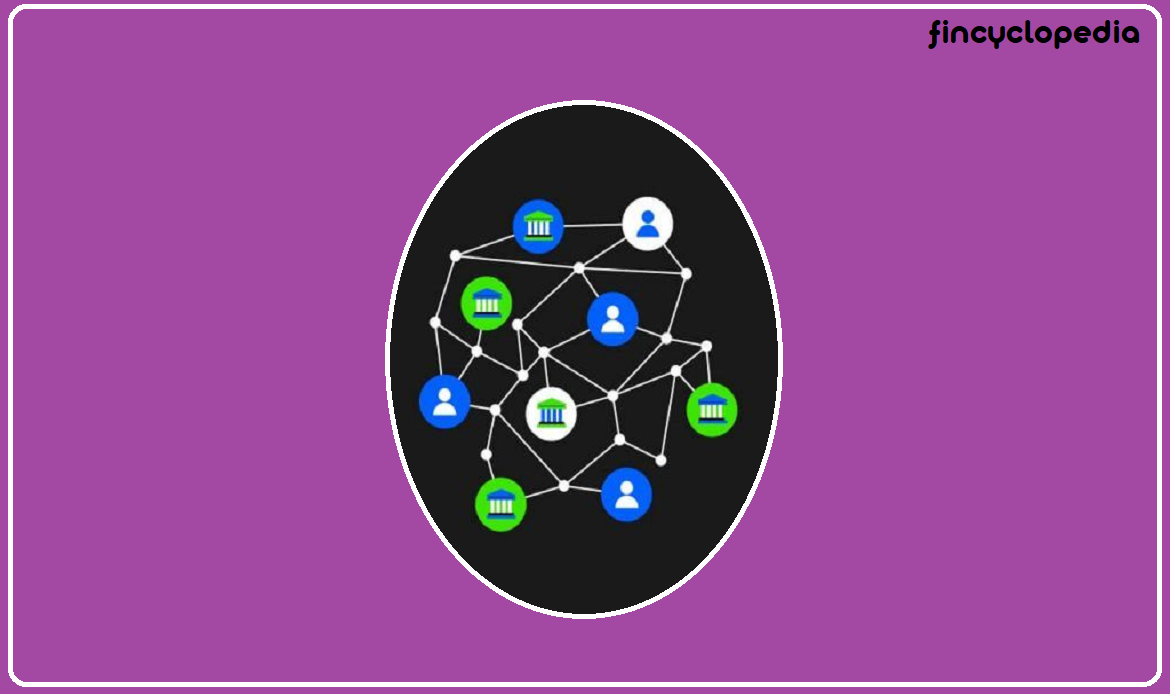

From the perspective of centralized custody, wrapped tokens are grouped in two different categories: custodial wrapped tokens and non-custodial wrapped tokens.

- Custodial tokens: a type of wrapped token in which the underlying token is held in custody by a centralized entity, and a wrapped version of the token is created and issued. For example, wrapped bitcoin (WBTC) is a custodial token entailing that a custodian holds the assets and issues coins as as tokens on Ethereum blockchain. As such, bitcoin can be represented and traded on the Ethereum network.

- Non-custodial tokens: a type of token that is locked on one network, and a wrapped version of that token is then created and issued automatically on another network. Once the issuing process is initiated, synchronization between the locking and issuance on the two networks has to be carried out (usually using synchronized smart contracts or an intermediate network running a certain protocol). On redeeming of the wrapped version, it is usually canceled (burned) and the original underlying token gets released.