Concept

A wrapped crypto is a crypto (cryptocurrency) that is pegged to the value of another original, real or traditional assets such as gold, stocks, shares, and real estate, or even another crypto. The crypto or token is deployed on the decentralized finance (DeFi) platforms. The original asset is ‘wrapped’ into a digital vault, and a newly minted asset is created to transact on other platforms. Apart from native crypto coins, wrapped cryptos can also be used to represent other assets such as non-fungible tokens (NFTs), stablecoins, and fiat currencies.

Wrapped crypto (also wrapped crypto tokens) are digital assets that mirror the value of another crypto that was created on a different blockchain. Wrapped cryptos are created to foster interoperability between different networks, allowing digital assets from one blockchain to be seamlessly used on another. Non-native assets can be used on any blockchain, while establishing bridges between networks and enabling interoperability in the crypto space.

In short, a wrapped crypto functions as a tokenized crypto asset that reflects the value of its underlying asset, enabling compatibility across various blockchain ecosystems to avail certain aspects and possibilities such as faster transactions, lower fees, and decentralized application (dApp) functionality, among others.

Main types of wrapped cryptos

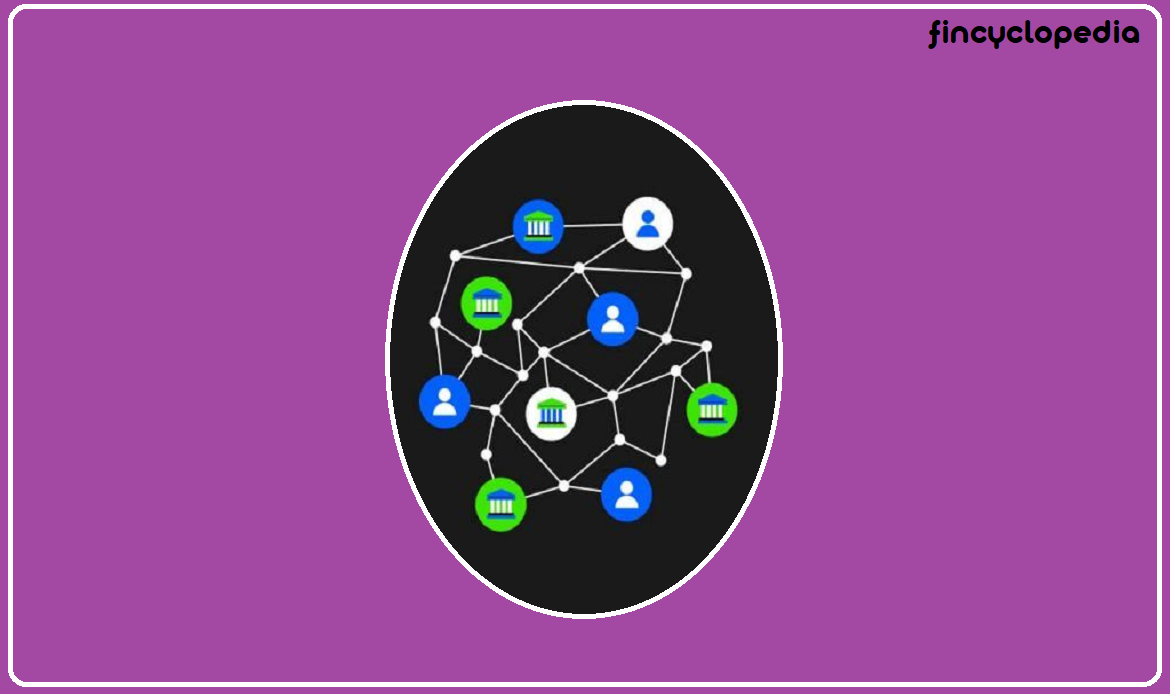

There are various types of wrapped cryptos depending mainly on the original asset pegged to. One example of a wrapped token is wrapped bitcoin (wBTC), which mirrors bitcoin on another network: the Ethereum blockchain. Another example is wrapped ether (WETH), representing a tokenized version of Ether on the Ethereum platform. This allows users to avail and benefit from the unique features and services offered on different networks in the crypto space. Wrapped ether represents ETH in a 1:1 ratio and mirrors its value, allowing holders or potential traders to interact by means of dApps and DeFi protocols across the crypto ecosystem.