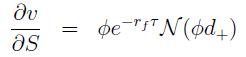

The sensitivity of an option‘s price (premium) to changes in the spot market. The spot delta tells how many units of a foreign currency must be traded so that an option with one unit of foreign-currency-denominated notional can be hedged. This delta is given by the following formula:

Spot delta = d value/ d spot

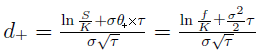

Where: S is the current price of the underlying; v is option’s price; φ is a binary variable which takes the value +1 in the case of a call and -1 in the case of a put; τ = T- t or time to maturity, rf is continuous foreign interest rate, and d+ is given by:

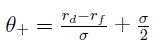

Where: K is the strike price; Θ+ is defined as:

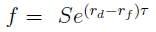

And f is the forward price of the underlying, which is given by:

The spot delta is one of four types of deltas which are commonly used in the forex markets. The other three types are:

An option is said to be “delta hedged” if a position has been created in the underlying (currency) in proportion to its delta. The delta hedge can cover the spot market for short dated options. However, with longer dated options or options on illiquid currencies, an investor may need to hedge the forward delta.