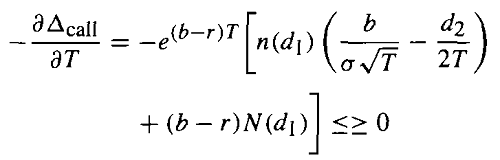

A delta greek that measures the sensitivity of delta (of an option position) to changes in time. In other words, it captures the effect of time on delta: the change in the value of delta as time to maturity draws closer. For a call option, DdeltaDtime is calculated using the following formula:

Where:

T is time to expiration, r is the risk-free rate, σ is volatility, and b is cost of carry.

N(d1) is the factor by which the present value of contingent receipt of the underlying asset exceeds the current underlying price. In other words, N(d1) is the present value of receiving the underlying if and only if the option finishes in the money. N(d2) is the present value of paying the strike price in the event that the option ends up in the money.

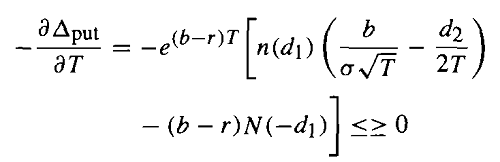

For a put option, DdeltaDtime is given by:

DdeltaDtime is also known as charm, delta bleed (delta decay) or DdelT.