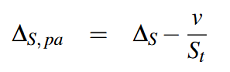

It stands for premium adjusted spot delta; a spot delta (standard sensitivity of a vanilla option with respect to changes in the spot rate/ price) that accounts for the correction induced by payment of the premium in foreign currency (FX options). Delta adjustment reflects the amount by which the delta hedge in a specific foreign currency has to be corrected. In equation form, it is given by:

Where: ΔS,pa is the spot delta premium adjusted , ΔS is the spot delta, and v is value in domestic currency.

The hedge would involve buying N(∆S − v /St ) foreign currency units to hedge a short vanilla position while the equivalent number of domestic currency units to sell is:

N(St ∆S − v)

It is also known as a spot delta premium adjusted.