A disclosure technique or approach that provides a detailed itemization of the contents of an entity’s accounts or financial statements. Supporting schedules communicate additional details on the items of accounts (e.g., assets and liabilities) that usually take the form of tables of data constituting material information about such items.The tables of data furnish users of financial statements with supplementary information by means of meaningful and insightful breakdowns of the items in question.

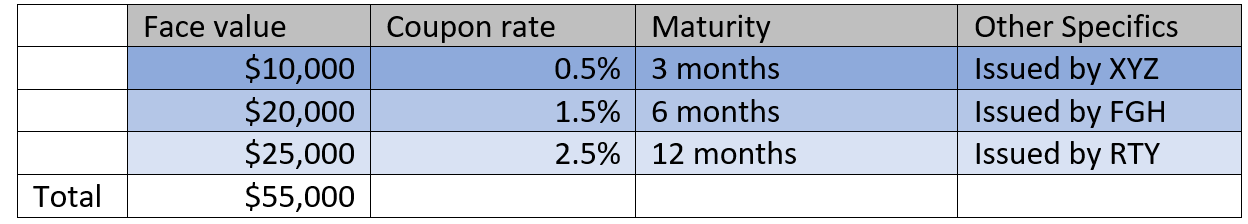

Supporting schedules help break down general categories of assets and liabilities into more detailed description, i.e., more broad categories. For example, an entity presents its holdings of short-term marketable securities, as a subcategory of its current assets, where a supporting schedule could be added to provide details about the specific of these securities in terms of amount, coupon rate, maturity dates, etc., all broken down in a convenient manner, as shown below:

Unlike other types of disclosure techniques such as parenthetical explanations and cross references, which are presented on the face of a balance sheet, a supporting schedule will appear alongside the notes (notes to financial statements).