The forward value or the worth of a foreign exchange (FX) forward contract that reflects changes of foreign exchange rates and/ or interest rates after inception.

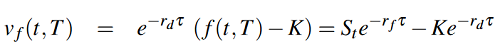

At inception, an outright forward contract has a value of zero. Thereafter, the value of the forward contract changes from zero and is determined as follows (which constitutes the forward contract value in domestic currency units, marked to market at time t):

Where: K is a pre-specified exchange rate>, St is the spot rate, rf is the foreign interest rate (cc: continuously compounded), rd is the domestic interest rate (continuously compounded), and τ is the time to maturity, equal to T − t.