Options are highly leveraged investments. In the underlying price moves favorably, an investor could earn much bigger percentage gains on his investment in options than he would on pure equity investments involving the same underlying. In this spirit, option leverage can be defined as the component of notional leverage that that results from the ability of options to provide exposure to the underlying asset, per unit of invested capital, that substantially exceeds the exposure associated with the cash asset. According, option leverage is one that an investor creates by paying or receiving a small amount (the premium) relative to the position value so that he can buy or sell an option that could in due course create a very large exposure dependent on the performance of the underlying asset.

In the parlance of options, option leverage represents the percentage by which an option’s market price (premium) changes for a 1% change in the underlying asset price. Leverage in derivatives, options included, works both ways and makes these instruments highly risky. However, in options the maximum possible loss on invested capital is limited to the premium paid by the buyer to the seller.

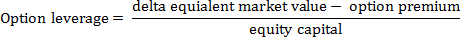

In calculation, option leverage is the difference between the market value of a delta equivalent exposure to the underlying asset (i.e., its cash equivalent value) and the market value of the option (which is the option’s premium or the invested amount). Delta indicates how much the value the option will change in response with changes in the market value of the underlying asset. The following formula gives option leverage:

In general, there are two major types of option leverage: call leverage (leverage of calls) and put leverage (leverage of puts).