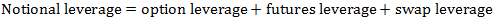

The use of derivatives such as options and swaps in the construction of a portfolio of assets/ investments. Notional leverage relates to other types of leverage in its being a component of financing leverage. This component is created through notional funding of options, futures, and swaps, among others. These financial instruments allow investors to take on risk without having to commit the full amount that an equivalent cash investment would require. In calculation, notional leverage relates the cash equivalent of respective instruments to the invested capital. In terms of composition, notional leverage is a combination of option leverage, futures leverage, and swap leverage as the following formula demonstrates:

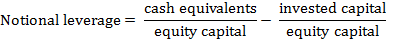

Notional leverage is also equal to the difference between the market value of cash instruments that would represent the equivalent risk exposure minus invested capital:

The derivative instruments reflect their time value until expiration and the price change but not the principal value of the underlying securities. Leverage typically, regardless of type, is associated with risk, since it can enhance either return or loss on equity invested in any asset.

Nevertheless, in the realm of derivatives, leverage doesn’t directly relate to the classical concept of risk. For example, market-neutral equity hedge funds are leveraged through their short sale of stock. A leveraged investment is likely to generate a superior return but with a higher expected volatility than the investment that has less leverage.