A series of futures contracts with sequential delivery months. Most often, it refers to a series of interest rate futures such as Eurodollar futures. A futures strip can be constructed by entering into long positions in a sequence of Eurodollar futures (for example, an April ED futures, a July ED futures, and an October ED futures). In swap markets, short-dated interest rate swaps can be priced off a strip of successive Eurodollar futures contracts.

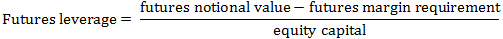

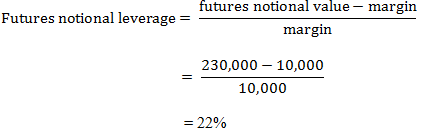

For example, if the amount of margin (invested capital) an investor in an equity index futures is required by the exchange to post as collateral is $10,000 and the notional value of the contract $230,000, then the notional leverage is

Forward contracts are essentially identical to futures contracts, except one difference: exchange listing. Forward contracts are typically issued over the counter (not through an exchange), and as such margin requirements are set by the issuing counterparty, rather than an exchange. In this sense, the same methodology of leverage calculation applies to forward contracts.