Swaps are over-the-counter (OTC) agreements that entail the exchange of two types of cash flows according to terms negotiated among the counterparties. They are issued by broker dealers who act as counterparties to both (legs) sides of the swap. For example, the two counterparties may agree to exchange a fixed coupon (from a fixed-rate bond) with the floating interest payment on a floating rate instrument. This agreement could be a five-year swap that pays out a fixed rate of the current five-year swap rate (the equivalent cash flow stream of coupons of a five-year risk-free security plus a spread) and receives the floating rate (usually LIBOR) that would prevail at the time of each payment.

Another popular type of swaps is the credit default swap (CDS) which is used by a counterparty seeking credit protection. This counterparty (known as the protection buyer) agrees to pay a premium to the protection seller in return for the right to receive compensation in the event the reference issuer ends up in default.

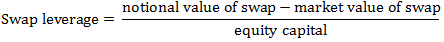

Due to their unique structure, swaps are entirely notionally financed at the time of issue, and as a result they provide investor with a significant amount of swap leverage. Swap leverage is the difference between the notional value of the swap and the market value:

Conventionally, the fixed rate at the time of issue will be determined so that the market value of the swap is zero.