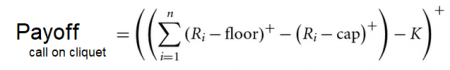

A cliquet (cliquet option) (an exotic equity derivative) that has additional (exotic) elements and features (as opposed to a vanilla cliquet). The additional features include call spreads, put spreads, local caps and floors, global caps and floors, global strikes, etc. These features contribute to alteration of the cliquet’s payoff. For example, a cliquet with a global strike can have its payoff as follows:

Where: + implies application of discount to the values, Ri is return for cliquet interval i, and K is the global strike.

The exotic versions of a cliquet are based on modelling of joint distributions of returns attained over the lifespan of an option, and subject to the cliquet mechanism. In other words, the returns are not distributed on a separate basis (as opposed to vanilla cliquets).

Other types of exotic cliquets include a reverse cliquet, Napoleon options, locally-capped globally-floored cliquets, etc.