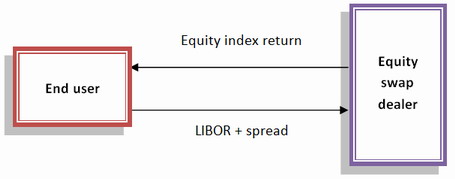

An equity swap where one party periodically pays a fixed amount and receives an amount based on the performance of a basket of shares or a stock index. In other words, this swap involves the payment of periodic cash flows based on the change (positive or negative) in the value of an equity index in return for a fixed or a floating rate of interest applied to the notional principal.

This swap can be structured in a way that the notional amount remains constant over the life of the swap or varies according to the changing level of the underlying index.