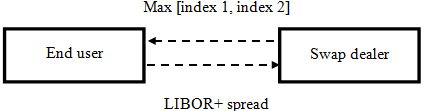

A variant on equity-linked swap in which the equity leg is linked to the larger of the total returns on at least two equity indexes. For example, assume an equity swap wherein the equity leg pays the higher return among two equity index returns: the CAC 40 total return or the Nikkei total return. It can be deduced that this swap is more attractive to the equity receiver than a swap linked to a single index, so it (the outperformance swap) will come with a higher swap coupon. The following figure illustrates such a swap:

This swap is sometimes known as a two-index equity swap.