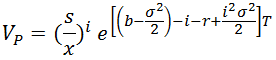

A simple derivative instrument that pays at maturity the ratio of its underlying price/ rate to its strike level, with the resulting figure being raised to some power. The value of a power contract is given by (see Shaw, 1998):

Where: S is the underlying price, X is the strike price, b is the difference between the risk-free rate and the continuously compounded dividend yield, σ is the standard deviation of the underlying, i is the power, r is the risk-free rate, and T is the option’s time to maturity.

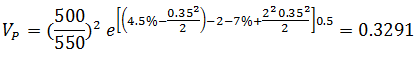

For instance, consider a power contract that has to go six months before expiration: the underlying is a stock index currently at 500, while the strike level is 550. If the risk-free rate is 7%, the dividend yield is 2.5%, and the index volatility is 30%, then the value of such a contract is: