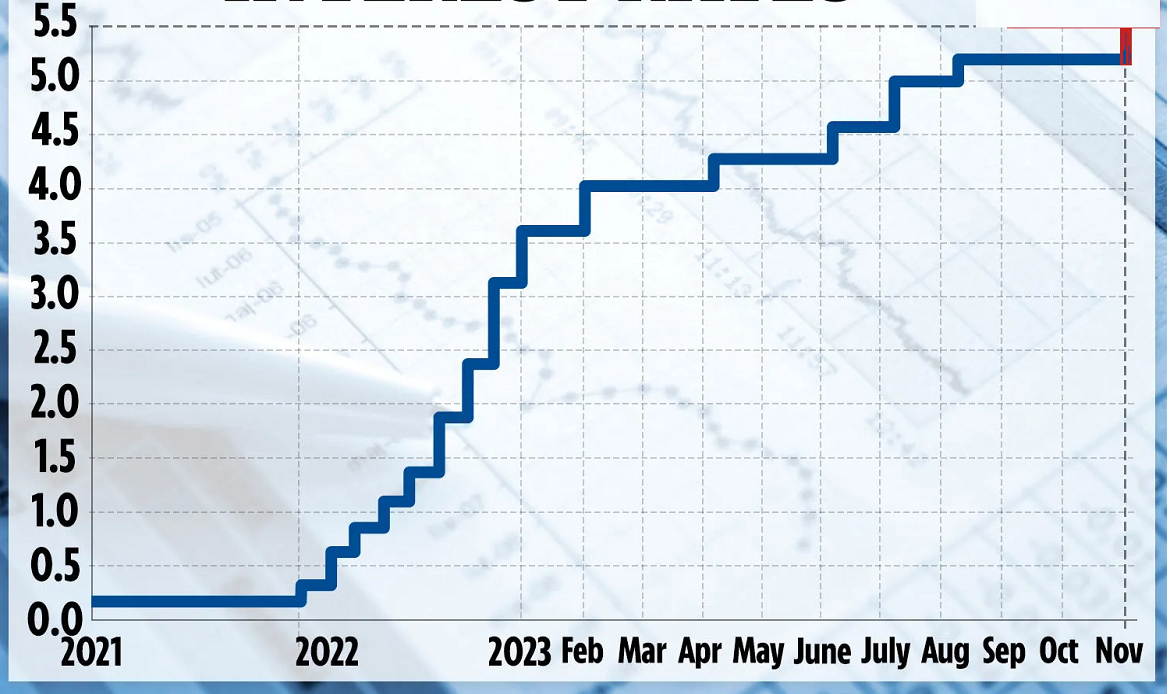

The difference between a bank’s lending rate and funding rate:

Bank spread = lending rate – funding rate

For example, if a banks raises funds through a CDB (certificate of dank deposit), at an annual funding rate of 11%, and lends money to a customer with an interest rate of 15% per year, then the bank spread is 4 percentage points:

Bank spread = 15% − 11% = 4 percentage points

The bank spread does not reflect its profit or profitability. This spread is usually used to cover administrative expenses, taxes, provisioning, etc.

After subtraction of the respective coverage of such expenses, the amount left over reflects the bank’s profit relating to that specific transaction.

In practice, a bank estimates its spread as the difference between interest rates of loans (extended by institutions for similar transactions) and estimates for the average cost of funding (based on market indicators that reflect the average cost of money for a given duration or at any given time).