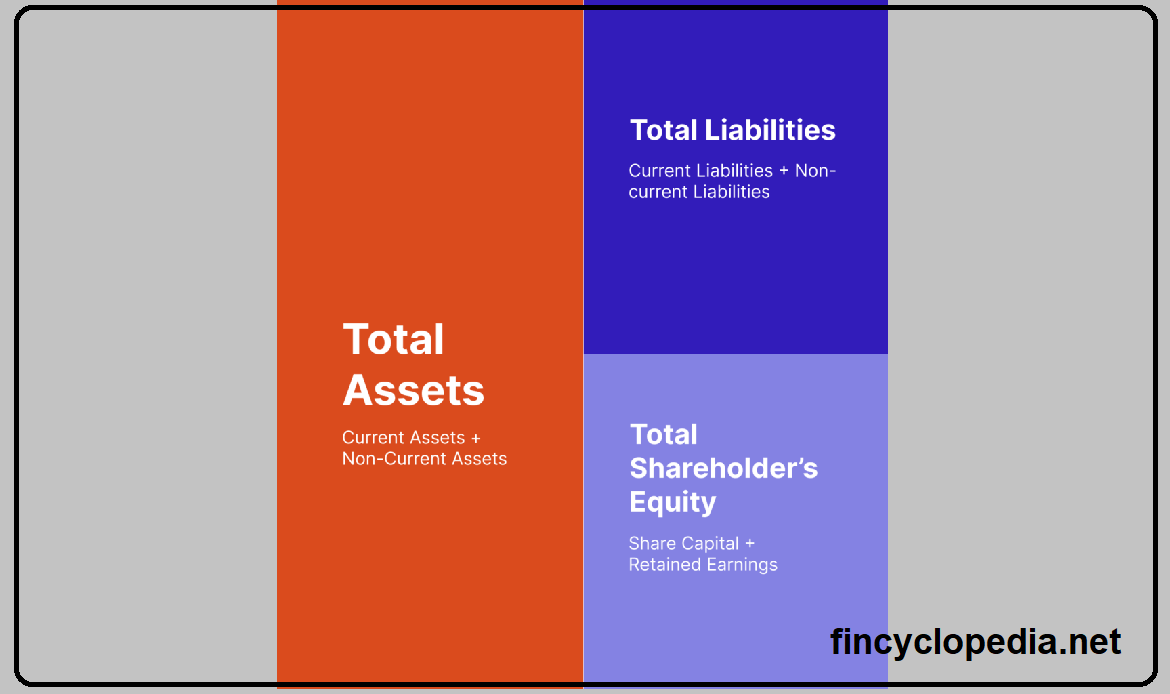

In simple terms, capital in a banking (a bank capital) represents the difference between a bank’s assets and its liabilities, and hence it corresponds to the net worth of the bank or the value of its equity at a certain point in time.

Capital is the sources of funding for a bank (on the liability side of its balance sheet) which consists of internally and externally mobilized funds whereby it finances its assets and operations. Broadly speaking, capital of a bank if made up of equity capital or equity capital and/ or debt capital.

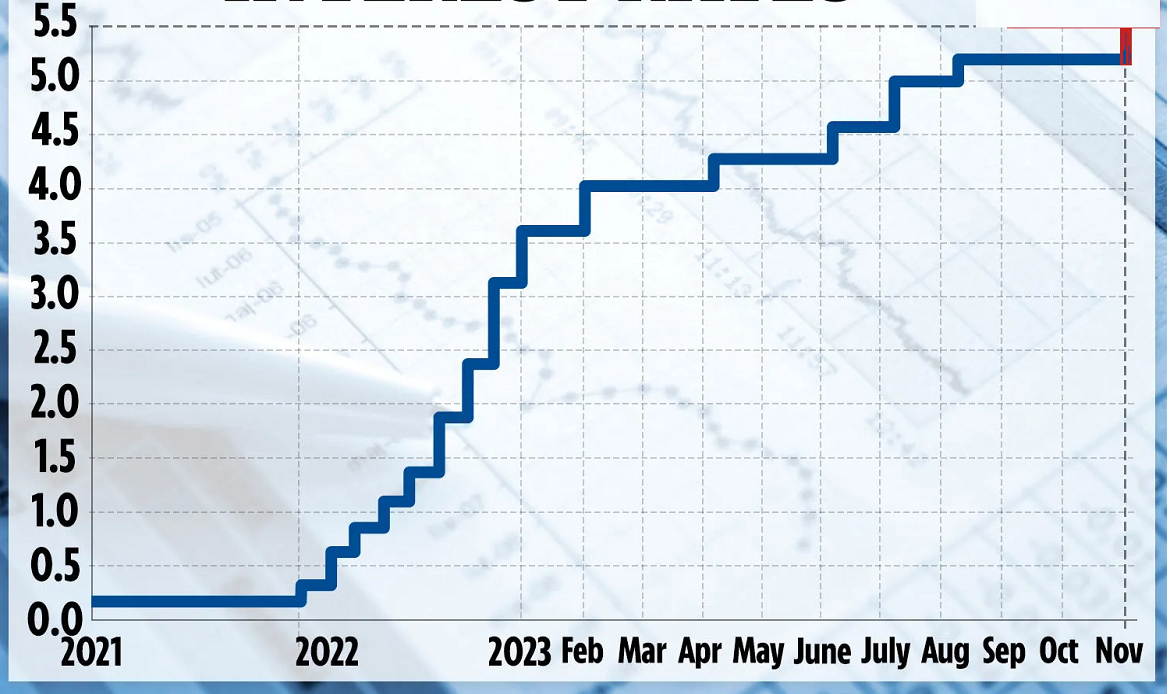

In relation to a bank’s capital requirements, regulatory capital is composed of different layers (or tiers) of funding, i.e., tier-1 capital (core capital), tier-2 capital (supplementary capital) and tier-3 capital (ancillary capital), depending on the types of capital instruments a bank has issued.

Capital = core capital + supplementary capital + ancillary capital

A bank’s common stock and retained earnings constitute the core capital items. Equity holders stand ready to cover losses on their investments before a bank’s creditors (such as depositors) do, and dividends to equity holders can be preserved (without payment) to help a bank solidify its financial position at the time of need. Debt can be considered part of capital for certain regulatory requirements if the debt is long-term, convertible into equity, or not redeemable— which together can help a bank absorb losses before depositors.

Collectively, these sources of capital form the so-called capital base (another name for regulatory capital). Differently perceived, capital base is the sum of (a) shareholders’ equity, (b) minority interests, and (c) subordinated indebtedness.

Depending of the purpose of its creation, capital is usually classified as regulatory capital, economic capital, financial capital, working capital, among others.