A bank’s solvency is the ability of the bank to meet its long-term obligations and support its expansion requirements over the long run. Bank solvency hinges upon two key components: bank capital (as reflected in its equity-asset ratio) and bank profitability (as expressed by its return on assets (ROA)). A solvent bank is one that operates with sufficient capital and hence is able to assume the risks of its financial activities, contributing to the stability of the financial system as a whole.

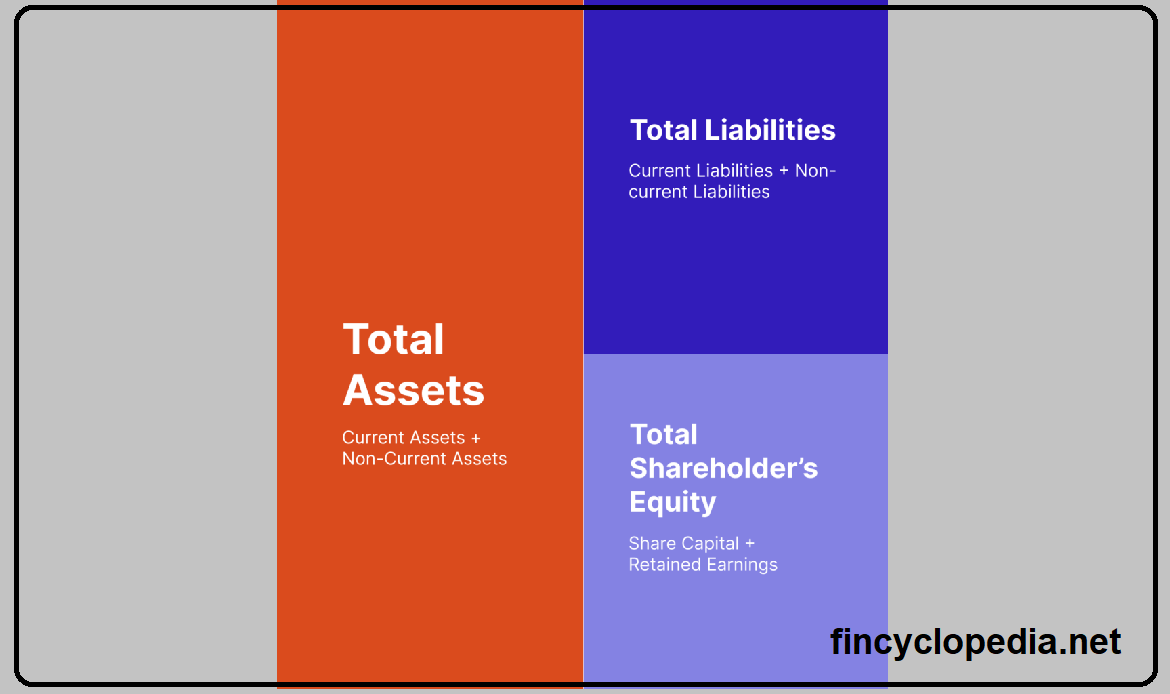

Measures of bank solvency take the form of market-based measures and regulatory measures. For example, Z-score is an indicator of bank solvency reflecting the key two factors: equity-asset ratio and ROA. It is computed as the sum of the equity-asset ratio (bank capital) and the return on assets (bank profitability), divided by the standard deviation of the return on assets (profit volatility). A high Z-score means a high level of banking stability, and vice versa.

Bank solvency and liquidity are interconnected. Concerns about bank insolvency can lead to liquidity shortages. Increased expectations about a bank insolvency (e.g., declines in credit rating) can prompt deposits withdrawal/ drains and increase interbank funding costs as depositors and interbank counterparties become more concerned about the bank creditworthiness, hence causing a liquidity shortage for the bank. Similarly, when a bank faces a liquidity shortage, it might be compelled to sell its less liquid assets (usually at distorted prices). If other banks in the system are also forced to sell less liquid assets, liquidity shortages may result in fire sales and consequently impact asset prices (downwardly pressures, hence, causing solvency problems.