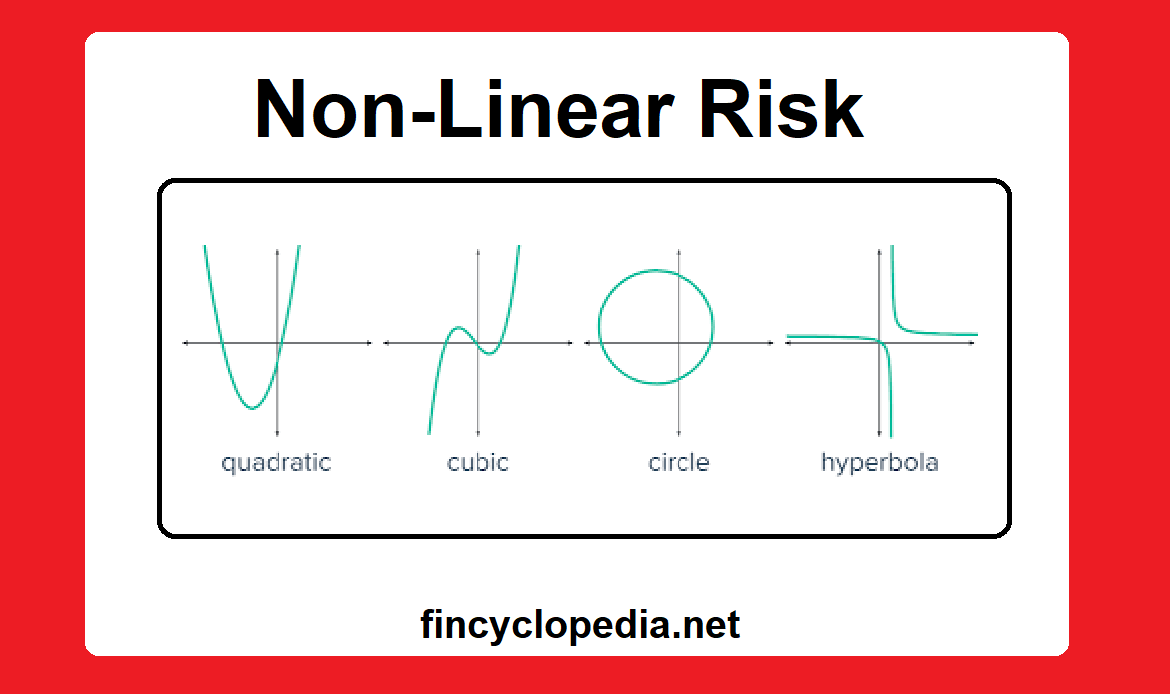

Non-linear risks represents the risk that the profit and loss of an financial instrument/ a portfolio/ an investment changes in a non-linear fashion- that is, an more or less proportionate manner. A linear risk arises when a 1:1 relationship between price movement and profit/ loss movement does exist. For example, a stock is associated with a linear risk: if XYZ stock price increases by $1 (no matter the trading price) the holder will make a $1 profit (capital gain).

On the other hand, a non-linear risk does arise when such a relationship is non-linear. A bond features such a risk: if the yield on a 10-year bond (4% coupon) increases by 100 basis points, the holder would lose more proportionately (in the market value of the bond) when the yield increases from 1% to 1.5%. But if the yield increases from 4% to 4.5%, the loss would be substantially less. Generally speaking, as yields fall, bond prices become increasingly sensitive to their movement (a type of risk known as negative convexity).

Generally, non-linear risk is common in certain non-linear products/ instruments such as options/ exotic swaps/ structured trades which involve both linear risk and non-linear risk. For example, swaptions feature exposure to the underlying swap as well as the option volatility.

In other words, the main examples of non-linear risks associated with such trades or products include:

- Bond risk.

- Option risk and option volatility.

- Swaption risk.

- Exotic swap risk.

- Structured trade risk.