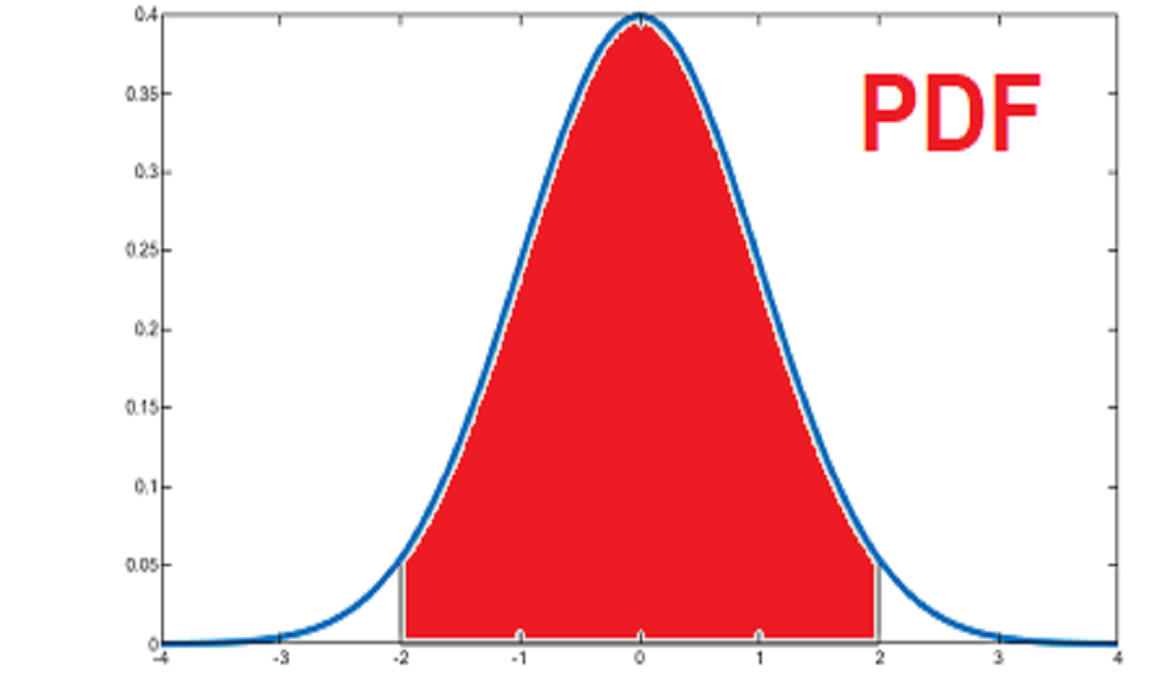

A measure of risk (value at risk, VaR) that represents the volatility to positions, investments, assets, liabilities or commitments comprising portfolios as measured in changes in fair value resulting from fluctuations in market prices (trading book effect).

These exposures arise in the banking book and meet the criteria for trading book treatment. The methodology to calculate non-traded VaR is similar to traded management VaR, though the two measures cannot directly compare. Both traded and non-traded VaR tend to increase in response to increased market volatility (usually driven by market shocks and revised rate hikes).