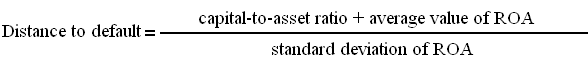

It stands for distance to default; a measure of risk that is based on the probability distribution of the income earned by a firm (e.g., a bank). In other words, it indicates the extent to which income would have to decrease before the firm would be forced to default on its debt. Using return on assets (ROA) and capital-to-asset ratio, the formula of distance to default (DD, or DTD) is:

This figure represents the number of standard deviations below the mean that return on assets (ROA) would have to decrease so that the capital is wiped out and the company is forced to default. The higher the value of distance to default, the lower a company’s risk, and vice versa.

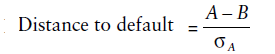

Distance-to-default can also be expressed as the distance between the asset value (A) of a company and its liabilities (B) related to the standard deviation of the former (i.e., asset risk) at a specific point in time:

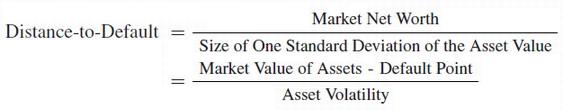

The default risk of a company increases when the value of its assets approaches the book value of its liability. It defaults when the market value of its assets is below the book value of its liabilities. In this sense, distance-to-default can be expressed as follows:

Where: default point represents the asset value at which the company will default.