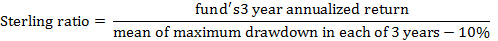

A measure of risk-adjusted return that is designed to apply the maximum drawdown as a measure of risk. This ratio is calculated by dividing a hedge fund’s annualized return over the past three years by the mean of the maximum drawdowns in each year. Thereafter, the mean drawdown is trimmed down by a 10 per cent in order to scale the ratio in a more realistic manner. The following formula demonstrates how the sterling ratio is constructed:

A basic feature of this ratio is that it takes into account the risk of drawdown. However, its application is limited to certain situations, especially where drawdown figures can comfortably fit into the ratio. Furthermore, there is a serious shortcoming associated with the three year interval the ratio covers: positive returns or a substantial drawdown might materialize just prior to that interval. If the previous three years have not seen even a single drawdown, this ratio will be useless.

This ratio was developed by Deane Sterling Jones.

Comments