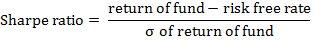

It stands for beta and volatility adjusted return; BAVAR ratio is a risk-return measure that is derived from the Sharpe ratio, but is characterized by its ability to it adjust for correlation in addition to volatility. It allows the investor to deduce whether the additional return provided by a hedge fund that is more correlated to the market justifies its lower diversification. Starting off from Sharpe ratio that is given by:

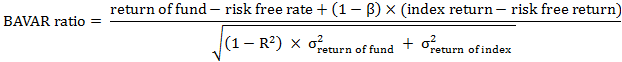

BAVAR ratio can take the following form:

where: β is the coefficient of the return on a respective equity index in the regression equation. R2 is the coefficient of determination of the regression of the fund’s return on that of the index. The expression (1-B) is the amount of additional exposure to underlying equity investment that is required to make the hedge fund at par with market (i.e., its beta =1). The returns of the fund are the dependent variable that is regressed on the index returns which represent the independent variable. The nominator is the sum of the return of the hedge fund and the required additional exposure to the equity index. As the above equation shows, the denominator of the BAVAR ratio is constructed by plugging the standard deviation of the beta-adjusted fund into the Sharpe ratio.

For more on BAVAR ratio, see: BAVAR ratio in application.

Comments