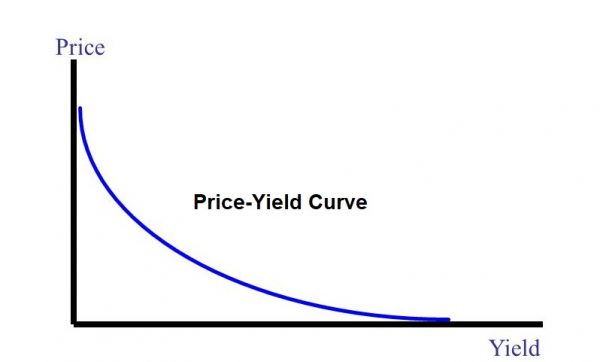

A curve that depicts the relationship between the annual yield on a coupon bond (coupon-bearing bond) and its price. Coupons are paid as a fixed percentage of the bond’s par value (face value) typically on a semi-annual basis. At maturity, a bondholder is paid the last coupon in addition to the bond’s par value (principal).

This curve implies an inverse relationship between the price of bonds and bond yields. The curve has a convex shape, and the amount of “whip” in this curve is known as convexity.