The all-inclusive price of a bond. That is, the market price of a bond or a similar fixed-income security in addition to any accrued interest. This is the price that is actually paid for the bond in the market. Put another way, it is the clean price (quoted price) of a bond plus accrued interest:

Dirty price = clean price + accrued interest

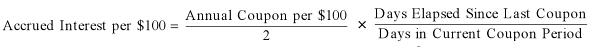

For example, if the dirty price of a bond is quoted as 99.1, this means the buyer would pay, for every $100 nominal of the bond, a price of $98.5. Assume the bond has a coupon of 5% and that 150 days have elapsed from the last coupon date to the next fixing date. The accrued interest would be:

Accrued interest per $100 = (5/2) × 150/181 = 2.0718

The dirty price is then:

Dirty price = 99.1 + 2.0718 = $101.1718

The dirty price of a bond is also known as the all-in price or gross price.