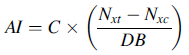

The net interest accrued on a bond since its last ex-dividend date. The following formula is usually used to calculate next accrued interest:

Where: AI is the next accrued interest, C is the bond coupon, Nxt is the number of days between the ex-dividend date and the calculation date, Nxc is the number of days between the ex-dividend date and the coupon payment date, DB is the day base or daycount base (360 or 365).

Conventionally, interest accrues on a bond from the last coupon date, inclusive, up to the value date, exclusive. The value date in most cases coincides with the settlement date for the bond, or the sale date. When a bond is quoted without accrued interest, its price is said to be clean (or flat):

Clean price of a bond= dirty price – next accrued interest

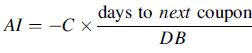

The next accrued interest is typically negative for bonds that trade ex-dividend:

Bonds that do not have an ex-dividend interval (such as US Treasury bonds and Eurobonds) usually trade cum dividend from a coupon date to another.