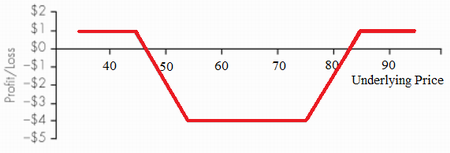

A complex and versatile option trading strategy (basically an albatross spread) which involves selling one deep in-the-money option, buying one in-the-money option, buying one out-of-the-money option, and selling one further out-of-the-money option, all on the same underlying. Investors pursue such a strategy when the underlying is expected to significantly break out in either direction. The short albatross spread is effectively a short condor spread with an extended strike difference between the two middle strike prices.

The short albatross can be established using either calls or puts. As such, there are two main versions of this spread: the short call albatross and the short put albatross.