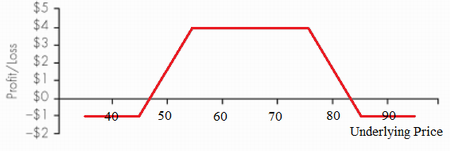

A complex and versatile option trading strategy (basically an albatross spread) which involves buying one deep in-the-money option, selling one in-the-money option, selling one out-of-the-money option, and buying one further out-of-the-money option, all on the same underlying. Investors pursue such a strategy when the underlying is expected to show minimal movement within a specific period of time. The long albatross spread is effectively a long condor spread with an extended strike difference between the two middle strike prices.

The long albatross can be established using either calls or puts. As such, there are two main versions of this spread: the long call albatross and the long put albatross.