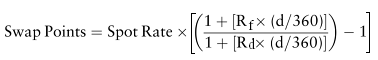

Foreign exchange swaps (FX swaps) are typically quoted in terms of pips (exchange rates are generally quoted up to five figures- e.g. 1.2436, the last digit ‘6’ is called the pip). If Rf denotes the short-term rate that may be earned by investing in the foreign currency (also known as the term currency), Rd represents the short-term rate associated with the base currency, and d is the number of days between the far and near dates, then the swap points can be given by:

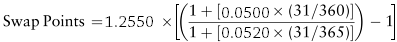

Suppose, for example, the dollar short-term rate is 5% and the euro short term is 5.20%, whilst the spot rate is 1.2550 $/ €. A one-month swap rate may be:

Swap Points = – 0.0001, or minus one pip. In other words, the buyer of euro will be expected to pay one pip against having the opportunity to earn a slightly higher interest rate over the term of the FX swap.