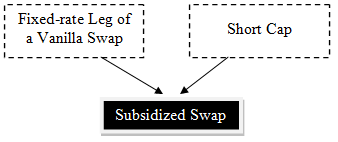

A swap that combines a plain vanilla swap with a cap. An investor may construct a subsidized swap by paying the fixed rate of the vanilla swap and selling a cap:

A subsidized swap typically pays a fixed-rate below the market rate. However, if rates rise above a certain trigger level, the fixed-rate payer will pay a floating rate set below the then prevailing rate. The result is a below-market fixed swap that reverts to a below market floating rate. The cap premium is used to reduce the fixed rate paid under this swap.

This swap may particularly serve the needs of a company that seeks to lock in the floating rate of its debt. If the floating rate remains below the cap strike, the company pays the fixed rate minus the prorated cap premium:

Payment = fixed rate – cap premium

If the floating rate exceeds the cap strike, the company pays the floating rate minus the amount of the cap strike plus the prorated premium minus the swap fixed rate:

Payment = floating rate – fixed rate – (cap strike + premium)

This swap is sometimes referred to as a trigger swap.

For more, see this example about a subsidized swap.