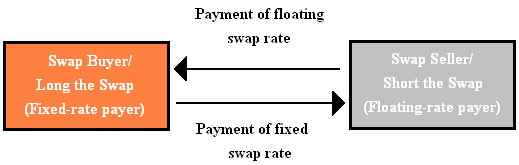

A basic interest rate swap whereby a fixed rate is paid for a floating rate in the same currency. In other words, this swap involves two counterparties agreeing to exchange, on designated future dates, two series of interest payments, one fixed rate and the other floating rate, calculated using some pre-defined formula, on a specific notional principal. This is the most common type of interest rate swap where payment are made in arrears and netted out against each other. The following diagram illustrates the structure of such a swap:

For example, the fixed-rate payer may agree to pay the other counterparty (the fixed-rate receiver) a fixed rate of 5% per year on a notional principal of $50 million at the end of each year for the next five years. In return, the fixed-rate receiver (who is also the floating-rate payer) may agree to pay a floating rate of interest (say, LIBOR) semiannually in arrears for the same period of time. This leg is, thus, based on 6-month LIBOR on the same notional amount.

This swap is also referred to as a fixed-for-floating swap or a contract for differences.