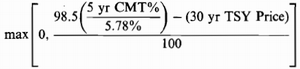

A bizarre swap transaction (a proprietary leveraged rate swap) that was entered into between Bankers Trust (BT) and Procter & Gamble (P&G) on November 2, 1993, and involved extremely exotic bells and whistles (its interest-setting formulas were based on the correlation between five- and 30-year bonds). The swap was to mature in five years, and the counterparties undertook to exchange semiannual payments on a notional principal of USD 200. BT paid 5.30% per year, whilst P&G paid the average 30-day commercial paper rate (CP rate) minus 75 basis points plus a specified spread. The spread was zero for the first fixing date (May 2, 1994), and thereafter it was calculated for each fixing date using this formula:

The motivation of P&G behind this transaction was a potential significant reduction in medium-term financing costs (actually, P&G hoped that this spread would be zero, and therefore it would be able to exchange fixed rate payments at 5.30% against obtaining a funding of 75 basis points below the CP rate. Bankers Trust subsequently outlined the 5/30 swap on paper along with a printed time-decay analysis. In the above formula, 5-year CMT denotes the constant maturity Treasury yield, while the 30-year TSY price refers to the midpoint of bid and offer cash bond prices for the underlying Treasury bond that bears an interest rate of 6.25% and matures on August 2023. In early 1994, interest rates skyrocketed, driving bond prices abysmally down, and inflicting P&G with huge losses.