The liabilities that a bank holds on its balance sheet (statement of financial position). Banks liabilities consist of deposits and bank borrowing (issued debt securities) from other institutions. Deposits include checkable deposits (demand deposits) and nontransaction deposits, among others.

Bank liabilities refer to the items owed by a bank as part of its funding resources (in addition to its own capital or equity) that help finance its assets (bank assets) in order to it operate and offer its services to the customer base. Bank liabilities are usually concentrated in money-related assets (monetary liabilities) and the broader category of financial liabilities (that mainly include items arising from a contractual obligation to deliver financial assets (cash, securities, etc.) to a counterparty, or from a contractual obligation to exchange financial assets or financial liabilities with a counterparty under conditions that may not be favorable to the bank.

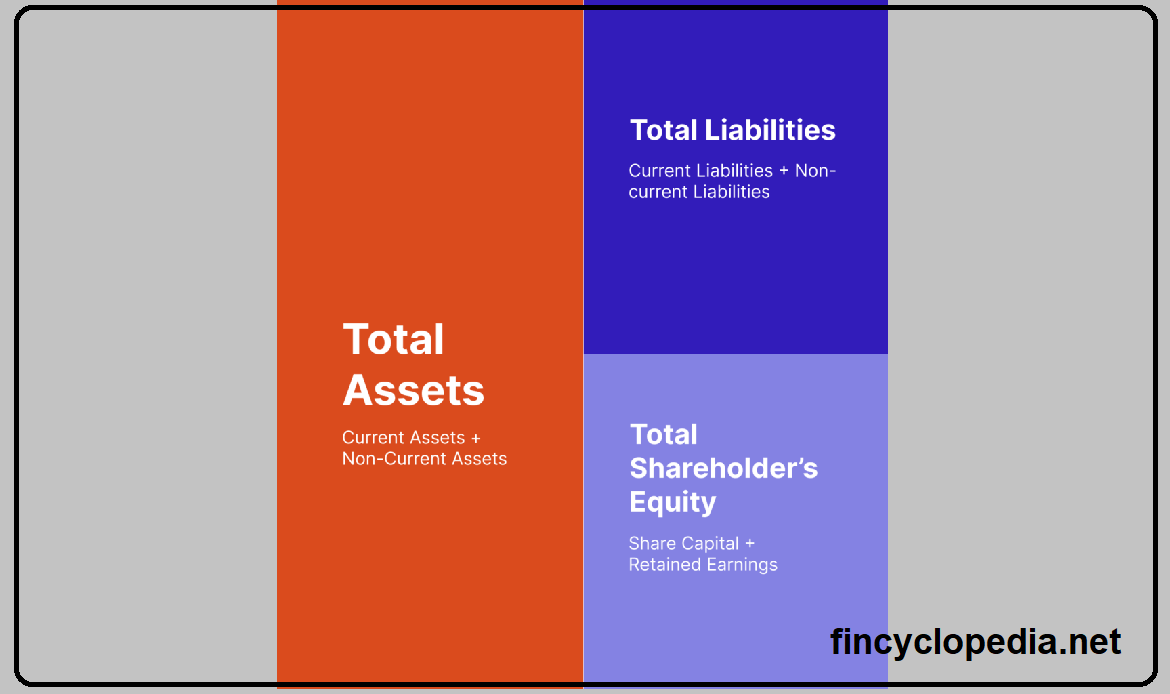

The difference between a bank’s assets and its liabilities, is capital (equity) representing the net worth of the bank or its equity as a going concern.