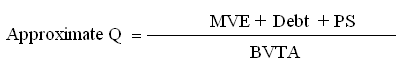

An improved version of Q ratio (Tobin’s Q) which relates the market value of a company plus the liquidating value of its preferred stock to the book value of its total assets:

Where: MVE denotes the market value of equity; PS is the liquidating value of preferred stock; debt is the book value of long-term debt plus short-term liabilities minus short-term assets; BVTA is the book value of total assets. This variant to the Q ratio is widely used in practice due to a major shortcoming in the Q ratio- access to replacement cost data is quite difficult and sometimes impossible